The Cyprus apartment market has remained highly active, with nearly 10,000 transactions recorded in 2024, generating €2.3 billion in total value. But what does this mean for developers, investors, and agents? By analysing the latest data, we uncover key trends shaping the market, and highlight where opportunities lie.

Apartments drive market activity

Apartments continue to dominate Cyprus’ real-estate sector, with Limassol leading in both transaction volume and value. The city accounted for 28 per cent of all apartment sales, but a staggering 47 per cent of total value (€1.08 billion), reinforcing its position as the premium real-estate hub of the island. Nicosia and Larnaca also show strong activity, while Paphos captures a significant share of the mid-market segment. Ammochostos remains the smallest market, raising questions about liquidity in the region.

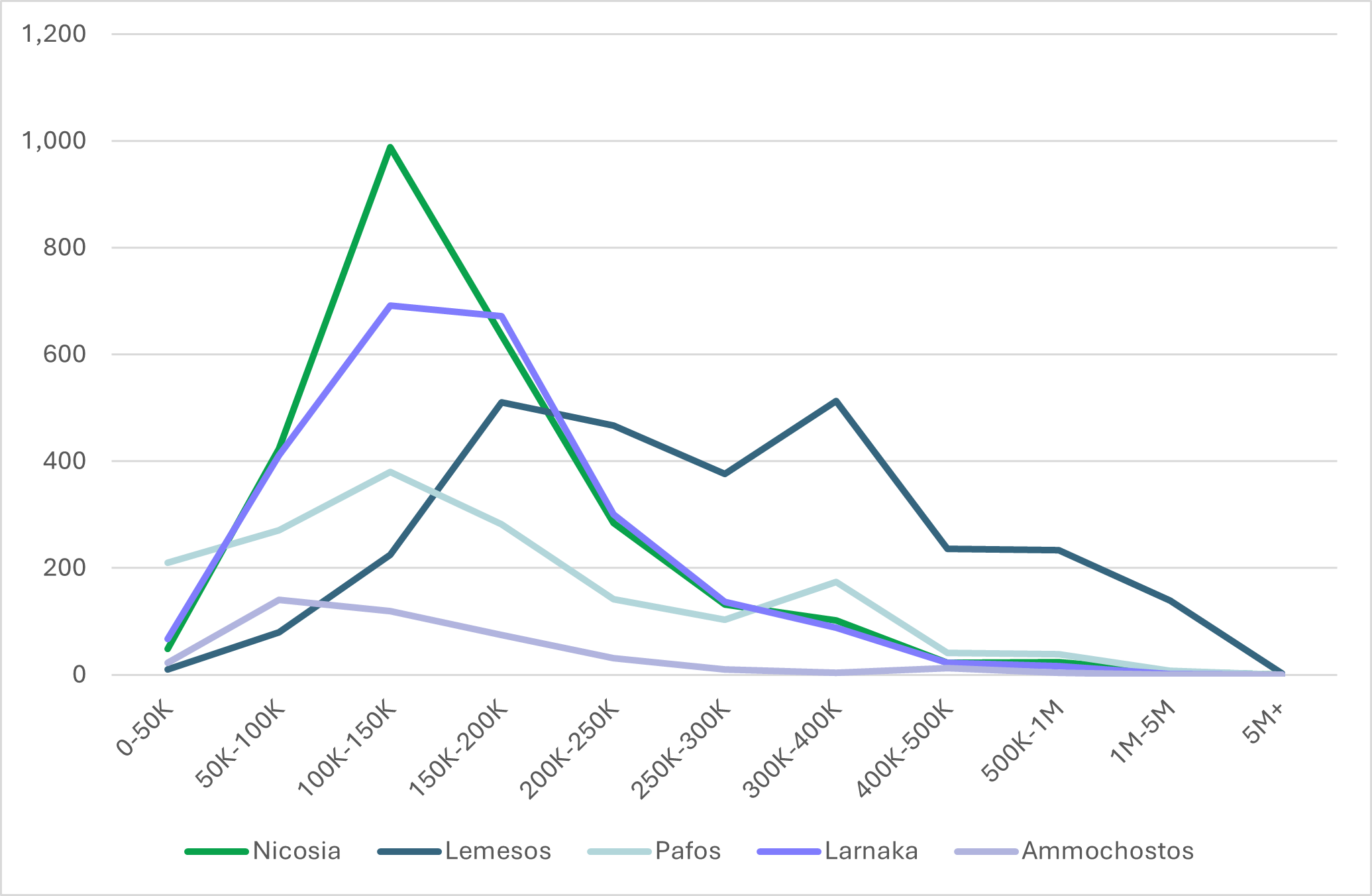

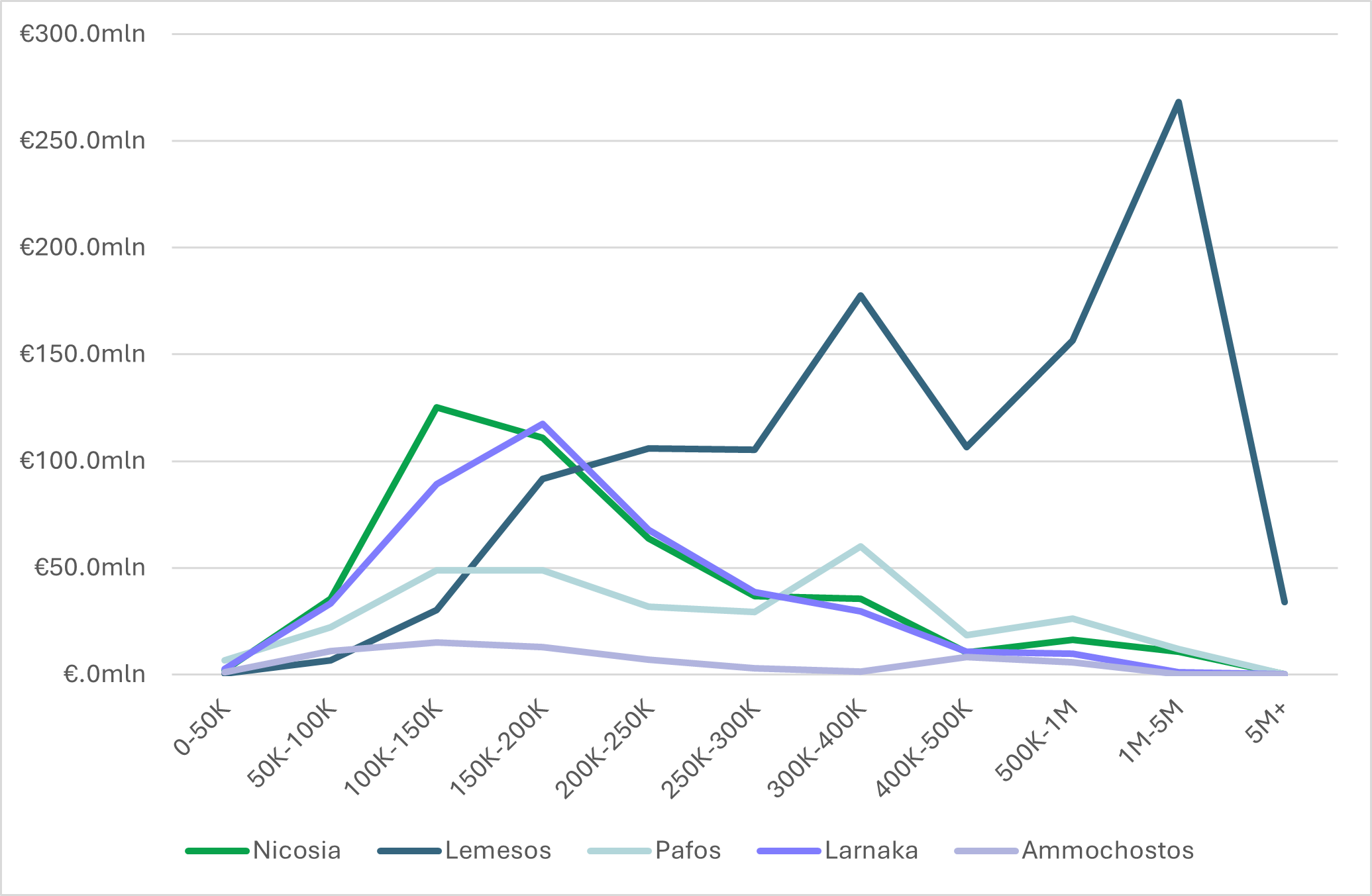

Understanding price distribution enables developers, investors, and agents to identify the most active market segments and emerging trends.

Apartments transacted by price range (number)

Apartments transacted by price range (total value)

Market opportunities

For developers:

- Limassol’s high-end growth – With €1.1 billion in transactions, demand for branded residences and seafront apartments remains strong.

- Mid-market expansion in Paphos & Larnaca – The €150,000-€300,000 range is in high demand, creating opportunities for affordable luxury developments.

- Land banking in Nicosia & Limassol – Rising plot sales indicate strong future development potential for mixed-use and sustainable communities. However affordability constraints may limit local demand and developers should be mindful of oversupply risk in the luxury segment.

- New residential concepts in Larnaca – As an emerging market with significant transactions, Larnaca presents an opportunity for smart housing developments targeting foreign buyers and locals alike. However, there is a significant pipeline of sizeable projects with limited commercial (employment) opportunities to match the increase in residential supply.

For investors:

- Short-term rentals in Paphos & Larnaca – High demand for holiday rentals near beaches and city centers presents attractive yield potential.

- Yield-generating apartments in Nicosia – With stable local demand, Nicosia presents a lower-risk investment for long-term rentals targeting professionals and students.

- Undervalued assets in Ammochostos – Low transaction volumes present an opportunity for early-stage coastal investment, particularly for developers targeting vacation homes and short-term rental properties.

For real-estate agents:

- Aligning with buyer demand – The €100,000-€500,000 price range is the most active, helping agents target the right clients.

- International buyer focus – Limassol’s €1M+ segment continues to attract high-net-worth investors seeking residency benefits.

- Targeting emerging districts – Larnaca’s growing appeal suggests potential for agents to expand their networks and listings to capture demand from both local and foreign buyers.

How Ask Wire can help

With €2.3 billion in apartment transactions alone, Cyprus presents both opportunities and risks. Ask Wire’s real-time data insights help developers, investors and agents navigate the market, identify trends and make informed decisions.

Make smarter real-estate decisions. Subscribe to Ask Wire‘s RED platform today.