Setting goals, starting early and diversifying your portfolio

Smart investing comes down to a few key principles that when linked to an individual’s financial goals ensures preparedness and peace of mind. With the rise of digitalisation and easy access to information, it’s easy to become overwhelmed about where you should start, what you should choose and what/who to believe. We all hear stories like “if I bought x stock ten years ago, I would have been a millionaire”. While some do, most of us don’t. Below is an outline of a basic set of principles on smart investing.

Build a set of Goals

Take some time and write down a set of goals. Most of the time you will find that these goals center around certain key life events such as buying a home, supporting family needs such as education and retirement. Think about where you want to be and when and what that means in terms of wealth. Examples include:

I want to buy a home that is expected to cost €500,000 in five to seven years

My children are expected to go to university in 15 years with a cost of €150,000

I expect to retire in 25 years and require about €300,000 to supplement my pension

Start early

Starting early is key to meeting financial goals and don’t underestimate the power of compound interest. Re-investing your returns over time will assist you in building a robust portfolio over time.

Understand your risk profile and the fundamentals of diversification

One of the initial steps before beginning your investment journey is understanding the amount of risk you are willing and able to take. Appetite to take on risk depends on a multitude of factors including investment horizon or other personal circumstances. What is important to understand is that your ability and willingness to take risk can be calculated (usually through a questionnaire). The risk of a portfolio can also be measured so that both the risk of a portfolio and your own risk profile remain aligned.

Building a diverse portfolio is also key in managing risk, especially through volatile markets. Investors who concentrate their holdings in specific stocks or industries may expose themselves to financial losses that are higher than investment holdings across a broad market range.

Save consistently

Consistency is fundamental in everything we do including building wealth over time. Sporadic saving in an investment portfolio will ultimately result in you not meeting your financial goals. It’s important to maintain financial discipline and ensure you invest a predetermined amount on a regular basis like monthly.

Pro Tip: Set It and Forget It – set up a standing order at your bank to transfer funds into your investment account automatically

Educate yourself

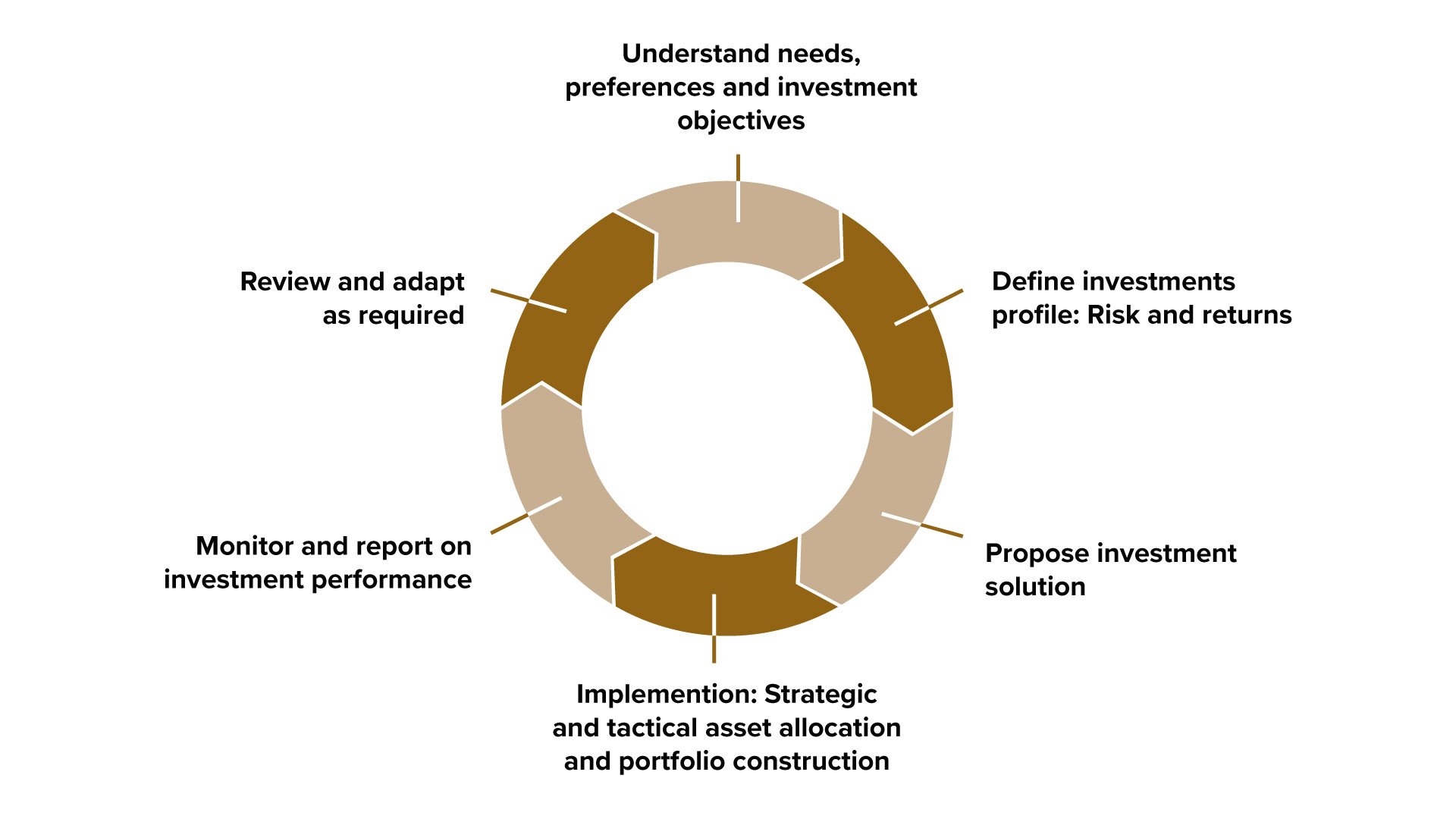

It is important that you educate yourself before beginning your investing journey. Take some time to understand the basic principles of financial markets. Once you understand the basics, it is highly advisable you seek a licensed financial advisor. Introductory meetings usually come at no cost and your advisor should be able to give you key insights into how your investment journey will unfold.

Time and patience

Wealth is not built overnight. It takes significant time, patience and financial discipline. The expectation of immediate profits and the belief that one can beat the market is often linked to significant financial losses. Invest consistently and prudently and let time and patience take care of the rest.

When you talk about a diverse portfolio are you speaking strictly about shares, or would you include property funds and start-up funds?

When we talk about a diverse portfolio, we mean a portfolio with holdings over a broad range asset classes and geographies. The average individual usually does not have access to private property and start-up funds for a number of reasons:

These funds are usually available only to ‘eligible investors’, meaning that the person would need to have sufficient knowledge and experience

They usually require higher initial investment and as such breach the optimal asset allocation for the average individual’s wallet size

They come with significantly higher risk and usually don’t fit within the average individuals risk appetite

There are options for investors to have exposure in alternative investments (including real estate) with smaller initial investments under a UCITS structure. UCITS are funds which are governed by strict EU regulation and available to retail investors. The proportion of alternative investments in a portfolio should be limited to the risk profile of the individual.

Should a person stick with investments for the long haul, or should one sell when they have made a good profit and invest elsewhere?

The goals one has, and their time horizon will dictate the overall strategic allocation of investments they should hold. The average individual has limited time, resources and knowledge to take market bets on a continuous basis. The important thing when investing is to remain consistent in saving throughout the time horizon. There will be instances where investments will be made on the low end of the market as well as on the high end.

Selling an investment when it has appreciated in value significantly will normally occur if the asset allocation of a portfolio has deviated significantly from its optimal state. For example, if equities have appreciated significantly in value in contrast to fixed income, you will probably need to sell to rebalance your portfolio holdings. Under an investment advisory mandate, your advisor will assist you in rebalancing your portfolio over time to achieve the best possible outcomes.

What would you consider the minimum amount someone should save every year, and for how many years to realise the investment goals you mentioned – house, children’s studies and pension?

The amount one needs to invest/save each year depends on what the expected needs are, the time horizon and the risk appetite. This is why you should start early and be consistent.

For retirement, it is important that one saves enough to maintain their pre-retirement lifestyle which, based on research from Fidelity, ranges between 55-85 per cent of pre-retirement income. One could easily estimate their pre-retirement income by assuming that their salary will grow with inflation until retirement. By starting at 25 years old and assuming you take advantage of your employers’ contributions to a provident fund, saving 15 per cent of your gross income should be sufficient to put you in a good place. This increases dramatically by age 35 to 25 per cent and further increases at age 40.

Thus, set your goals, understand your time horizon and don’t delay.