Bakong, the Kingdom’s national payment system, has achieved a highly impressive user metrics milestone with volumes reaching over 300 percent of the country’s GDP, leading Blockchain innovation tracker COINGEEK said on Wednesday.

This is a massive spike from the previous years, and the latest data provided by the National Bank of Cambodia (NBC) highlights the steady rise of Bakong during the last year.

According to NBC, the total Bakong volume stood at $150.61 billion (almost 330 percent of Cambodia’s GDP) from approximately 608 million transactions in 2024. The number represents a staggering 95 percent increase in transactions from 2023 figures, with cross-border and tourist use on a high growth trajectory.

Launched in 2020 by the apex bank, Bakong has gained steady traction in the country’s financial system. As per the NBC annual report, there are 30 million Bakong wallets, and over 4.5 million Cambodian merchants accept Bakong payments.

“The biggest driver of merchant adoption is lower transaction fees compared with traditional payment alternatives,” COINGEEK observed.

“Bakong’s settlement times and interoperability with a raft of systems continue to attract more merchants to the payment platform while a standard QR code for Bakong backs it.”

The NBC has been initiating a series of programmes to boost Bakong adoption metrics for users, such as a mobile payment system for tourists started in mid-2024.

Rielisation has been one of the key achievements, with the central bank turning to Bakong to promote Khmer riel (KHR) use in the country. Cross-border transactions on the platform are processed in riels, while tourists are urged to transact in local currencies rather than the US dollar.

In the 2024 Annual Report and 2025 Work Plan of the NBC, the number of registered Bakong users rose by seven percent to 642,500 as of 2024, with 608.32 million transactions.

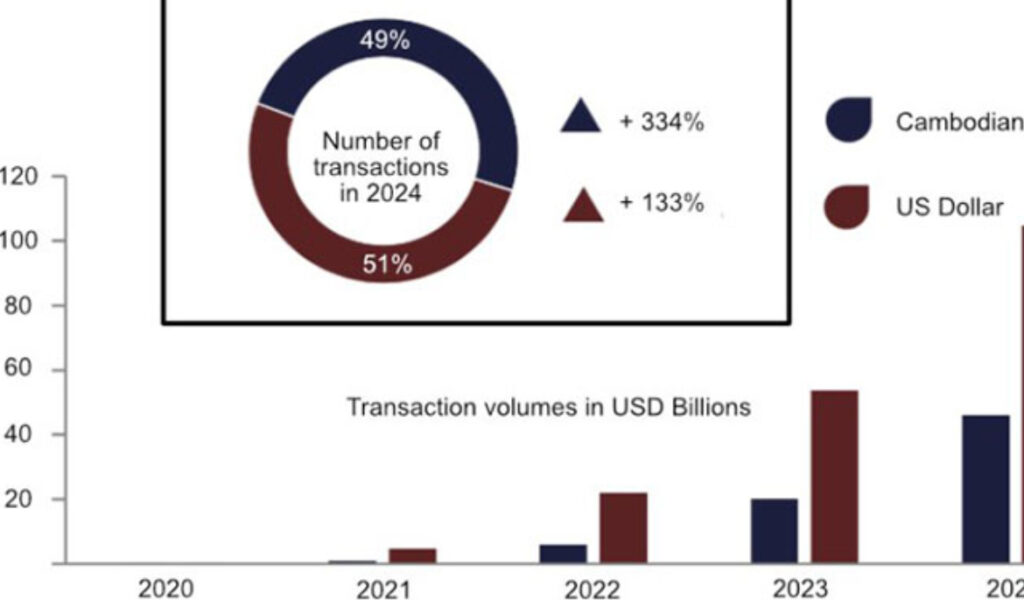

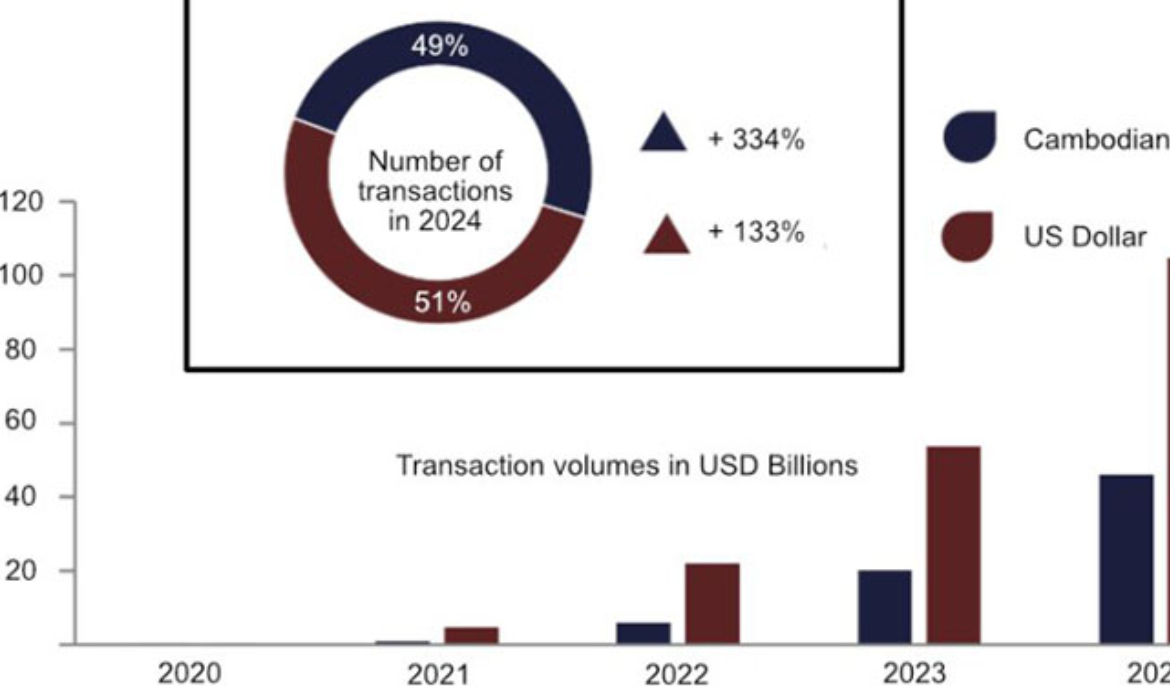

KHR transactions rose by 334 percent to 299.32 million while those in US dollar increased to 308.2 million transactions, up 133 percent, the report noted, citing that KHR transactions constituted 49 percent of total transitions.

The KHR transaction amounts totalled KHR183.74 trillion (approximately $45.8 billion), a year-on-year increase of 127 percent and US transactions amounted to $104.81 billion, up 95 percent, read the report.

“The use of Riel in the Bakong system has steadily increased after the Bakong system was launched,” the NBC stated in the report.

NBC Governor Chea Serey has been reaffirming that digital payment services have significantly contributed to enhancing financial inclusion, promoting innovation, and providing convenience and safety to users.

“The development of payment infrastructure has facilitated trade and economic activities both domestically and regionally and has contributed to the promotion of financial inclusion,” she said.

The Kingdom has steadily expanded payment system connectivity with countries in the region and international payment systems, offering a wide range of payment possibilities for Cambodians and international travellers, she added.