The Royal Group Exchange (RGX), Cambodia’s only authorised digital assets exchange, now boasts a user base of over 3,500 individuals exactly a year after its inception.

The trading platform using blockchain technology was launched in January last year, marking the beginning of a new history in Cambodia’s financial landscape.

It has also become the first approved digital assets exchange in the country, Thomas Schings, Senior Manager of the Royal Group, exclusively told Khmer Times yesterday.

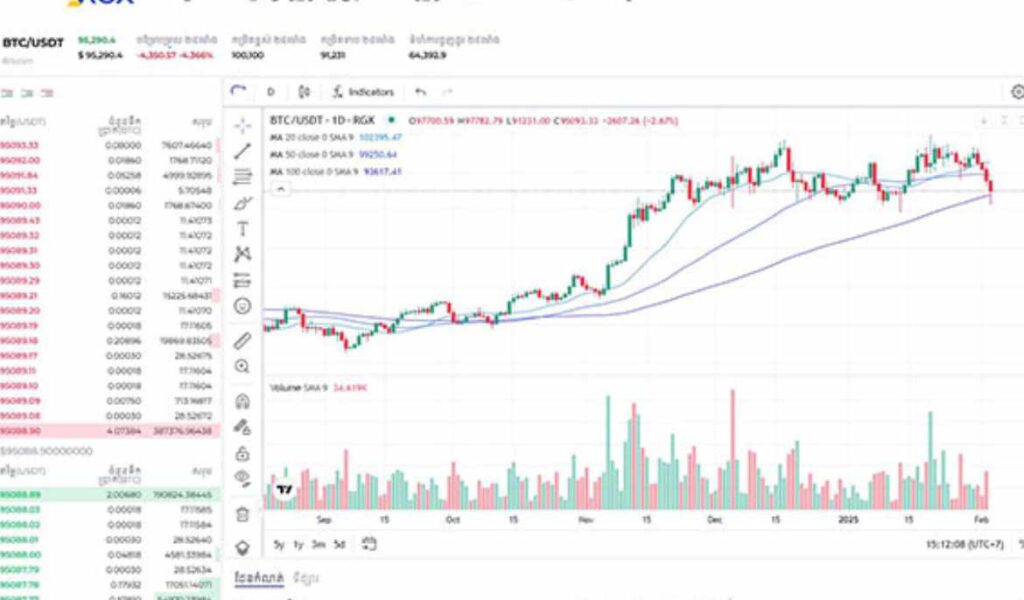

“Currently, RGX boasts a user base of over 3,500 individuals. While our trading volume is still modest compared to international competitors, such as Binance and KuCoin, we are currently seeing a monthly volume of several hundred thousand dollars,” he pointed out.

Thomas said, “RGX is encouraged by the consistent growth in the numbers each month and remains steadfast in the mission to become Cambodia’s premier digital asset exchange.”

“Our platform has experienced continuous growth, demonstrating our commitment to innovation and service. We have successfully built a trusted reputation within the community, which we consider crucial for our long-term success.”

When asked about the new set of regulations in the digital assets space introduced by the National Bank of Cambodia (NBC), he said: “The recent prakas indicates a progressive shift away from the previous ban on banks. However, it is important to note that this new regulation primarily legitimises certain stablecoins within the country. As such, there is still some ambiguity regarding NBC’s long-term vision and the specific stablecoins that may be permitted.

“We remain optimistic that the NBC will collaborate with Securities and Exchange Commission of Cambodia (SERC) to foster a stronger and more diversified financial sector in Cambodia. We believe that digital exchanges should be classified similarly to traditional stock exchanges, as recognised by global standards that treat digital assets as securities, a view that SERC also embraces.

“We hope the NBC will accept this perspective, allowing banks to engage with digital exchanges in the same manner they do with other regulated counterparts under SERC. This would facilitate seamless fund transfers in and out of RGX accounts, enhancing transparency and control for all regulatory bodies.”

Khmer Times earlier reported about the confusion prevailing among the investors and potential investors over the apex bank’s stance on digital assets and cryptocurrencies.

However, towards the end of the last year, NBC permitted commercial banks and payment institutions to offer services involving Category 1 crypto assets, such as backed or Stablecoins.

Stablecoins are a type of cryptocurrency that seeks to maintain a stable value by pegging their market value to an external reference such as a fiat currency like the US dollar, a commodity such as gold, or another financial instrument.

The directive sought to regulate operations involving digital currencies, reflecting Cambodia’s efforts to align with global financial trends.

Under the new rules, institutions must obtain prior approval from NBC to engage in activities such as exchanging crypto assets for fiat currencies, transferring crypto assets between accounts, and offering custody services. These institutions are barred from utilising customers’ crypto assets for their own purposes.

Looking ahead, Thomas said the success of the digital assets sector in Cambodia will largely depend on NBC’s recognition of digital assets as valuable securities. “Establishing a connection between investors, blockchain developers, and the formal fiat (banking) system could attract significant investment inflows into Cambodia.

“Our immediate goal at RGX is to establish partnerships with banks to enable users to conduct fiat-to-digital asset transactions with ease. Additionally, we aim to empower Cambodian projects by providing a platform for them to list on our exchange and raise funds for investment in the Kingdom.

“We envision facilitating innovative projects across various sectors, including digital, charitable, and real estate initiatives. To achieve this, we believe it is essential for all financial regulators to align and collaborate for a more robust financial ecosystem in Cambodia.”