Despite the fact that goods produced in Cambodia will be subject to 36% tariffs on all exports to the US from August 1, Cambodia’s footwear export activities to international markets — including the US — are still showing remarkably positive signs.

A report released last week by the Cambodia Footwear Association (CFA) stated that from January to June 2025, Cambodia exported $1.03 billion worth of footwear, a 33% increase over the same period last year. Footwear exports to the US amounted to $388 million, 38% of Cambodia’s total footwear exports.

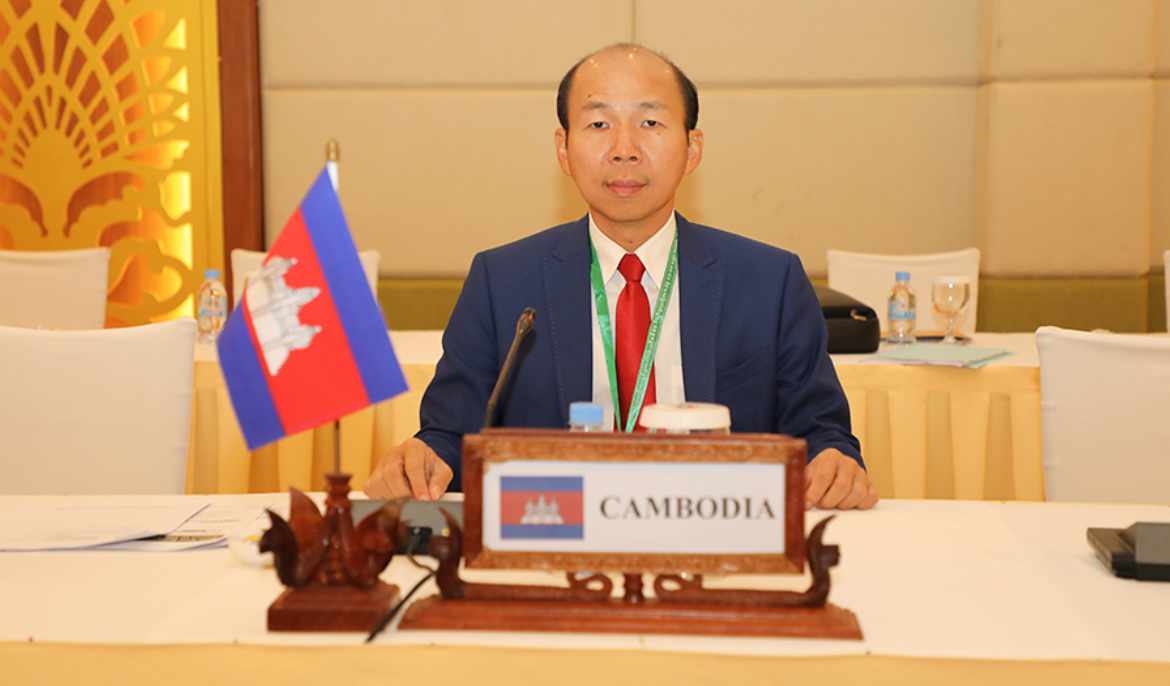

To understand the current state of the market, The Post’s Hin Pisei recently sat down with CFA president Ly Kunthai to explore key issues and offer insights to readers.

What are the key factors driving the growth of Cambodia’s footwear exports?

We all know that the current global political and economic climate is highly uncertain, which negatively impacts international trade. However, if we look at the Kingdom’s footwear exports, they have continued to experience notable growth.

Specifically, in the first half of 2025, Cambodia earned over $1 billion from international footwear exports, representing an increase of more than 30% compared to the same period in 2024. The main contributing factors include:

- Government Facilitation: The Cambodian government consistently supports factories and enterprises with policy initiatives such as tax facilitation, encouragement for raw material imports and maintaining stable electricity prices. In addition, the country’s new investment law plays a significant role in attracting and retaining investors.

- Investor Confidence: Political stability and robust economic growth have strengthened investor confidence, prompting many to choose Cambodia as a key footwear manufacturing base. The shift in orders from other countries to Cambodia has also contributed to this growth.

- Product Quality: Footwear manufacturers in Cambodia have maintained and improved product quality to meet international standards, fulfilling requirements from major brands such as Adidas, VF Corporation and Skechers. Their focus on sustainability, carbon emission reduction, and workplace safety has also boosted competitiveness.

The interior of one of the Kingdom’s many large footwear manufacturing operations with workers assemble men’s dress shoes in a footwear factory in Cambodia. Supplied

What is the Cambodian government’s approach to the US tariff measures?

The Cambodian government has made significant efforts in this area, including gathering input and preparing for negotiations with the US to find appropriate solutions to the tariff issue. This proactive response has instilled hope and confidence among investors and buyers across all markets.

Has Cambodian footwear expanded into any new markets?

Recently, CFA members have been working to expand into markets beyond the US, including the EU, Canada, Japan, China, the UK and South Korea.

Although these markets are currently smaller than the US in terms of volume, their growing presence reflects a positive trend toward market diversification. Export growth to these countries helps reduce dependency on a single market. Moreover, the Cambodia-China Free Trade Agreement offers additional opportunities to increase exports to China.

Do you expect Cambodia’s footwear exports to remain strong through the end of 2025?

Based on current trends and the supporting factors mentioned, I’m optimistic that Cambodia’s footwear exports will continue to rise through the end of 2025. This growth will be driven by sustained investor confidence, market diversification and a stable investment and economic environment both domestically and internationally. Additionally, an increase in raw material imports signals that purchase orders remain strong and that manufacturing activity continues to expand.

Are there any new investments in Cambodia’s footwear manufacturing sector?

Yes, Cambodia continues to attract strong interest from new investors looking to set up footwear factories. In fact, in the first half of 2025, several new factories were registered and began construction.

Several factors are drawing these investors to Cambodia, including government facilitation, investment-friendly mechanisms and fast-track document services that make doing business easier.

I can confidently say that Cambodia’s investment climate is favourable and attractive, especially as the country enjoys strong political stability and policies that support emerging market economies.

Where do most of Cambodia’s footwear investors come from?

More than 90% of investors in Cambodia’s footwear manufacturing sector come from China, Hong Kong, Malaysia and South Korea. These investors bring deep experience and advanced technology in footwear production and have chosen Cambodia as a key manufacturing location for the ASEAN region.