A report released by the Cambodia Securities Exchange (CSX) yesterday has detailed major securities market developments throughout 2024, as well as laying down the exchange’s goals for 2025, which include targets such as significantly increasing daily trading values, expanding new trading accounts and introduction of at least six new listings.

CSX’s report, ‘Market Situation in 2024 and Strategic Plans for 2025’, detailed that despite an unsettled global and domestic investment climate in 2024, Cambodia’s stock exchange achieved several notable milestones throughout the past year.

In 2024, CSX introduced two new listings to the exchange namely Telcotech and Royal Group Phnom Penh SEZ Plc, both bond-listed companies.

Last year CSX also witnessed significant growth in the number of active trading accounts, representing a 26 percent year-on-year increase compared to 2023.

12,745 new accounts opened throughout 2024, adding to a sum total of 58,394 active trading accounts.

The CSX report also celebrated improvements in domestic participation and investor confidence in the exchange, with local investors accounting for 93 percent of 2024’s total trading activity.

Meanwhile, the report highlighted that major transactions involving GTI, PAS, and PWSA shares last year resulted in a total trading volume of 1,213,554 shares, valued at a total of 6.266 billion riels.

Of this volume, foreign investors contributed 60 percent of funds, read the report.

Taiwan investors demonstrated the leader in terms of international participation, representing a 39.5 percent share.

In second place was Japan, responsible for 21.31 percent of transactions followed by China, 14.18 percent and Thailand, 5.36 percent.

However, due to limitations in cash flow, a domestic consumption downturn and global market uncertainties in 2024 the average daily trading value of the CSX decreased by 35 percent to 535 million riels, compared to 2023.

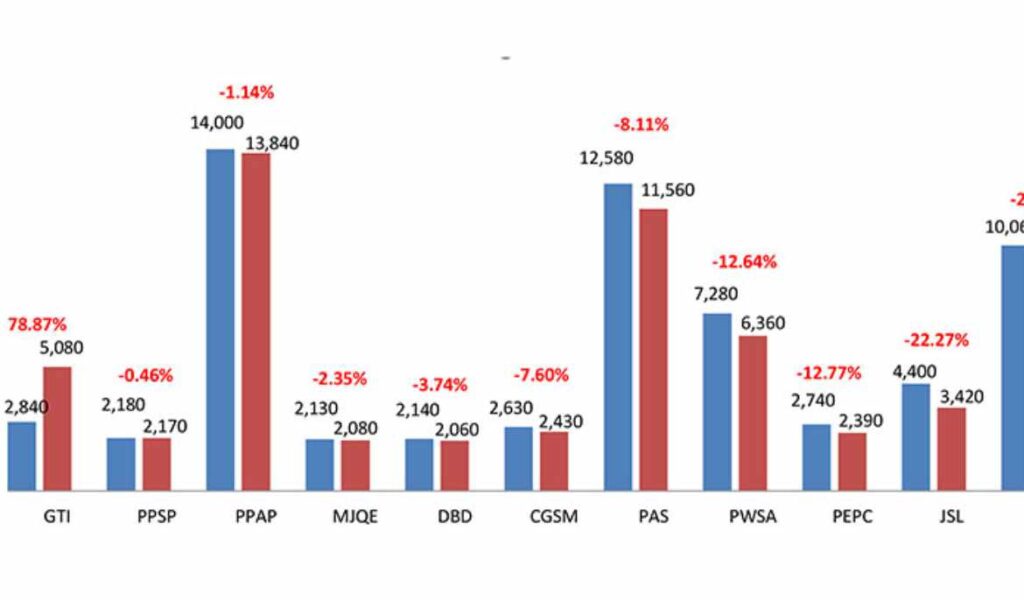

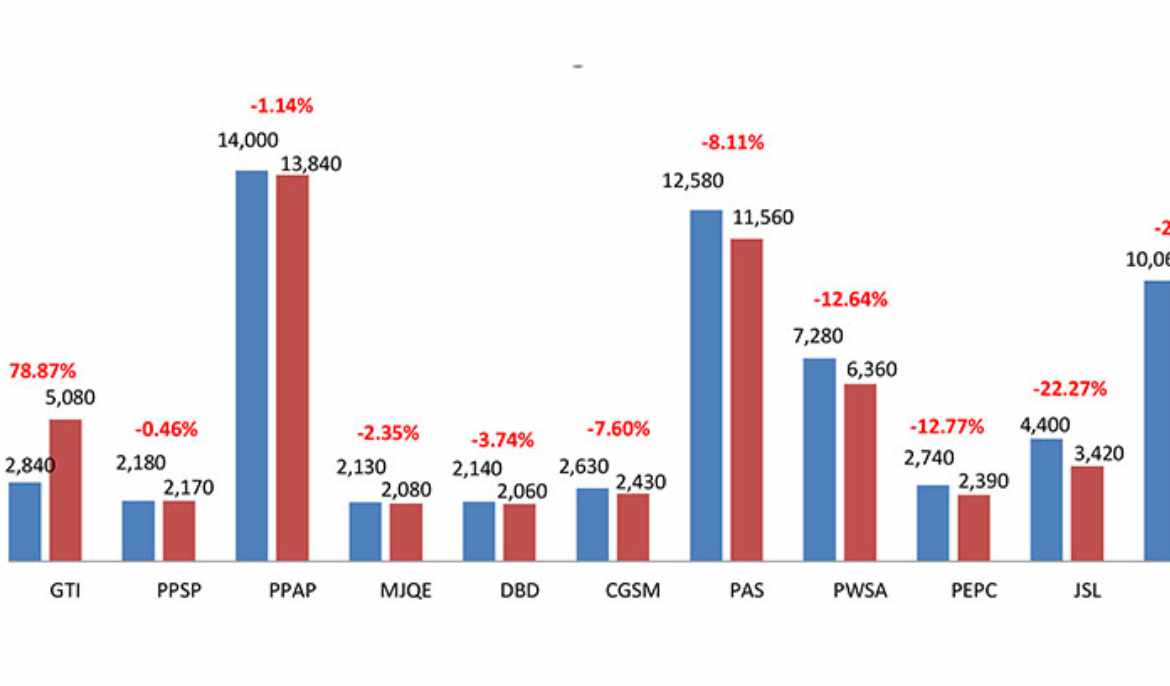

Meanwhile, the CSX Index dropped by 12.68 percent.

As well as major trading results, the report also highlighted key training and educational efforts completed by the exchange and its partners in 2024, aimed at improving market understanding and growing the exchange’s investor base.

These included various training programs, exhibitions and seminars, and a series of collaborations and memorandum of understandings (MoU) with educational institutions to promote financial literacy and investor understanding across the market.

Importantly, the report laid down the exchange’s key growth targets for 2025.

The CSX hopes to see trading values increasing significantly in 2025 with a target of raising the average daily trading value to $300,000.

Throughout 2025, the CSX also hopes to significantly expand market participation by adding 15,000 new trading accounts.

On top of this, the CSX report further said that the exchange will introduce at least six new companies to its boards in 2025.

“There will be three more companies that are expected to list equity securities, and four others will list debt securities,” the report added.

To achieve the proposed goals, however, the CSX report detailed that various innovations will be necessary.

Firstly, the exchange noted that technological innovations will help to aid exchange’s growth, including improvements to the CSX Trade platform such as cash deposit and withdrawal features, and the integration of artificial intelligence (AI) tools to allow for real-time query support for investors.

In terms of market mechanism reforms, the CSX intends to introduce margin trading in 2025, broadening options for lower-capital investors.

The CSX also said that it will adjust the daily price limit to 30 percent in 2025, along with shortening the settlement period for debt securities to T+1, and enabling T+N settlement for negotiated trades.

The CSX also intends to introduce a mechanism to allow securities to be used as collateral for loans, and thus potentially improving liquidity issues for investors.

The launch of Cambodia’s first Exchange Traded Funds (ETFs) is also on track for 2025, offering increased diversity to the exchange’s investment opportunities.

On top of these changes, the CSX said it will continue its strong focus on market education and capacity building in the new year through a host of training seminars and awareness programs.

Alongside these strategic plans, the CSX said that it anticipates a year of significant progress and opportunity for investors in 2025.

However, the report added that “ongoing collaboration with the Securities and Exchange Regulator of Cambodia (SERC), member companies, and other stakeholders will be crucial in achieving these goals.”