The Cyprus Securities and Exchange Commission (CySEC) is participating in World Investor Week, scheduled for October 7-14, with a strong focus on financial literacy.

“Financial literacy empowers citizens to manage their money effectively and make sound decisions regarding their financial activities,” stated Elena Karkoti, a Senior Officer at CySEC.

Karkoti pointed out that promoting financial literacy has been a longstanding strategic goal for CySEC, which advocates for integrating financial education into the core curriculum.

Karkoti expressed her support for the recent decision by the Ministry of Education, Sports, and Youth to introduce a financial education programme for third-grade secondary school students, calling it “a very significant step”.

She praised the Minister of Education for not only this initiative but also for the intention to expand the programme to include a dedicated weekly subject within the school curriculum.

Karkoti also highlighted the importance of teaching children basic money management skills. “It is crucial for children to understand basic principles and functions related to money management,” she explained.

“For example, they should be able to create a simple budget with their expenses and income, calculate how much and for how long they need to save to purchase something they desire, and recognise the importance of maintaining an emergency fund to cover unforeseen expenses,” she added.

Furthermore, she mentioned that young people must learn to identify investment risks, especially those associated with online and social media platforms.

“The creation of new, complex financial products and services, driven by rapid technological advancements, makes early financial education essential,” she said.

During informational lectures organised across all educational levels in Cyprus, Karkoti observed “enthusiastic participation” from students eager to learn more about financial matters.

The CySEC official also mentioned that financial education extends beyond secondary education. “The need for public financial education is systematically highlighted by European and international organisations,” she said.

In this context, she cited research showing relatively low levels of financial literacy among the general population in Cyprus.

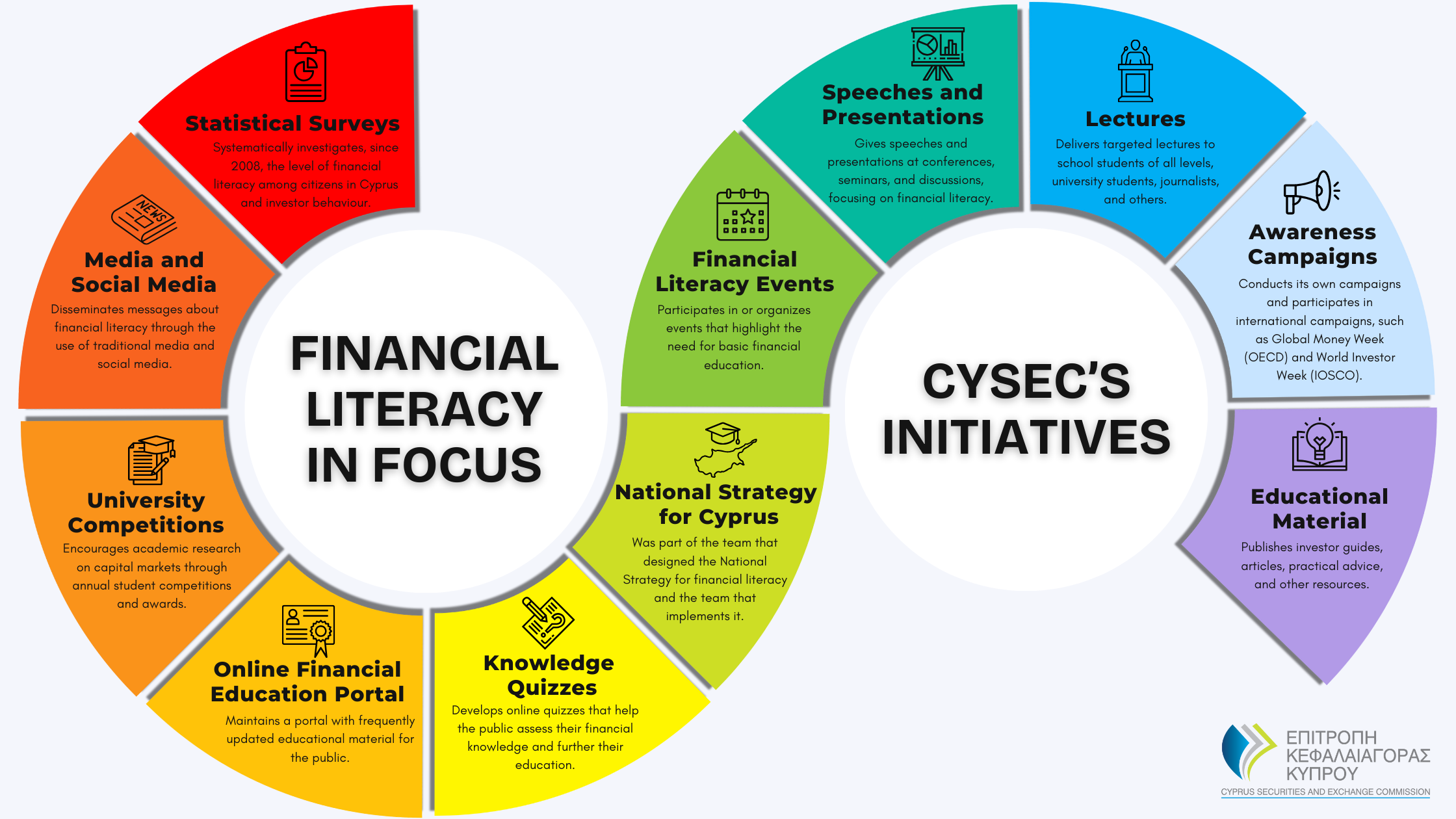

To address this, she continued, CySEC is committed to ongoing initiatives aimed at educating the public.

“CySEC maintains an online Financial Education Portal on its official website, regularly updated with educational material in simple and understandable language,” Karkoti explained.

The portal offers resources such as investor guides, articles, practical tips, and an online quiz to help users assess and improve their financial knowledge.

In addition to these efforts, CySEC is actively involved in designing Cyprus’ national strategy for financial literacy and collaborates with other organisations to implement it.

Karkoti highlighted that CySEC conducts awareness campaigns on current issues relevant to investors and participates in international campaigns like Global Money Week and World Investor Week.

“During this year’s World Investor Week, CySEC plans to focus its activities on the need for timely financial education for children and teenagers,” she said.

Furthermore, to reach a wider audience, CySEC engages in public speaking at conferences and seminars, and utilises social media to disseminate information.

“Our actions and initiatives aim to protect investors and promote the financial well-being of the public in general,” Karkoti said.

“With proper education and timely access to relevant information, we can create a new generation of citizens able to make sound financial decisions and tackle the many challenges of the modern economy,” she concluded.