An increase in property sales reported yesterday by the Ministry of Interior has sparked concerns about the sector’s future trajectory, particularly for 2025, despite current positive growth indicators.

Industry professionals warn that the combination of high demand, reduced supply, and delays in new stock entering the market could trigger further price increases.

According to Land Registry data cited by the Interior Ministry, new residential property sales maintained an upward trend, with apartments dominating the market share compared to houses. The first nine months of 2024 saw a 19.2% increase in sales compared to the same period last year.

Between January and September 2024, 5,253 property sale contracts were registered, comprising 4,335 apartments and 918 houses. This trend was consistent across all districts, with the highest percentage increases recorded in regions typically showing lower foreign investment interest.

Apartments emerge as preferred choice

The shift towards apartment purchases, showing a nearly 30% increase nationwide, contrasts with a 9.2% decline in house sales compared to January- September 2023. This trend is particularly pronounced among young people and new families, reflecting housing costs and difficulties in securing larger mortgages required for houses.

The geographic distribution of new purchases suggests many citizens, particularly in Nicosia, have utilised housing assistance through revised schemes aimed at revitalising mountain, remote, and disadvantaged areas.

Market analysis

Polys Kourousides, president of the Cyprus Property Valuers Association, told Phileleftheros that while the data shows increased housing demand, it raises red flags for the sector. He explained that the high sales volumes of the first nine months are expected to continue next year, without corresponding increases in supply.

New units are entering the market with significant delays due to bureaucracy in local authorities, which have been issuing permits since June 2024. Kourousides warned that continued high demand would likely lead to price increases due to supply constraints.

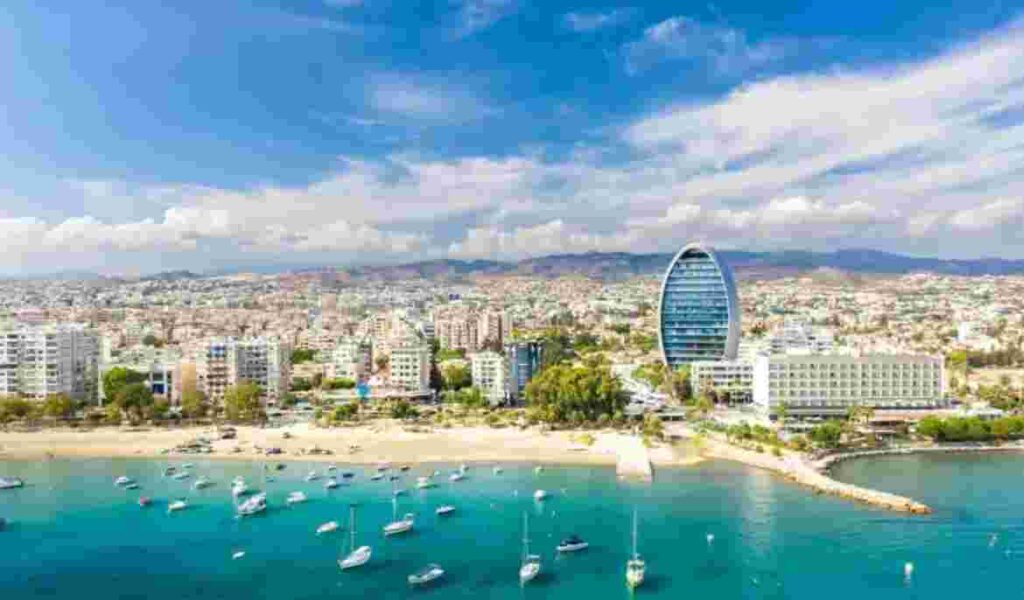

Nationwide, buyers are equally split between Cypriots and foreigners, though Nicosia sees 90% Cypriot buyers. Larnaca and Paphos attract numerous foreign buyers, particularly Israelis, while Limassol shows moderate foreign interest. The Famagusta district records lower transaction volumes, mainly for holiday homes.

Kourousides noted that apartments, typically purchased for owner-occupation rather than investment, particularly in Nicosia, are predominantly two-bedroom units ranging from €220,000-230,000.