The Council for the Development of Cambodia (CDC) is seeking to make it easier for foreign firms to register

as applicants for Qualified Investment Projects (QIP) in Cambodia through improvements to the online registration system.

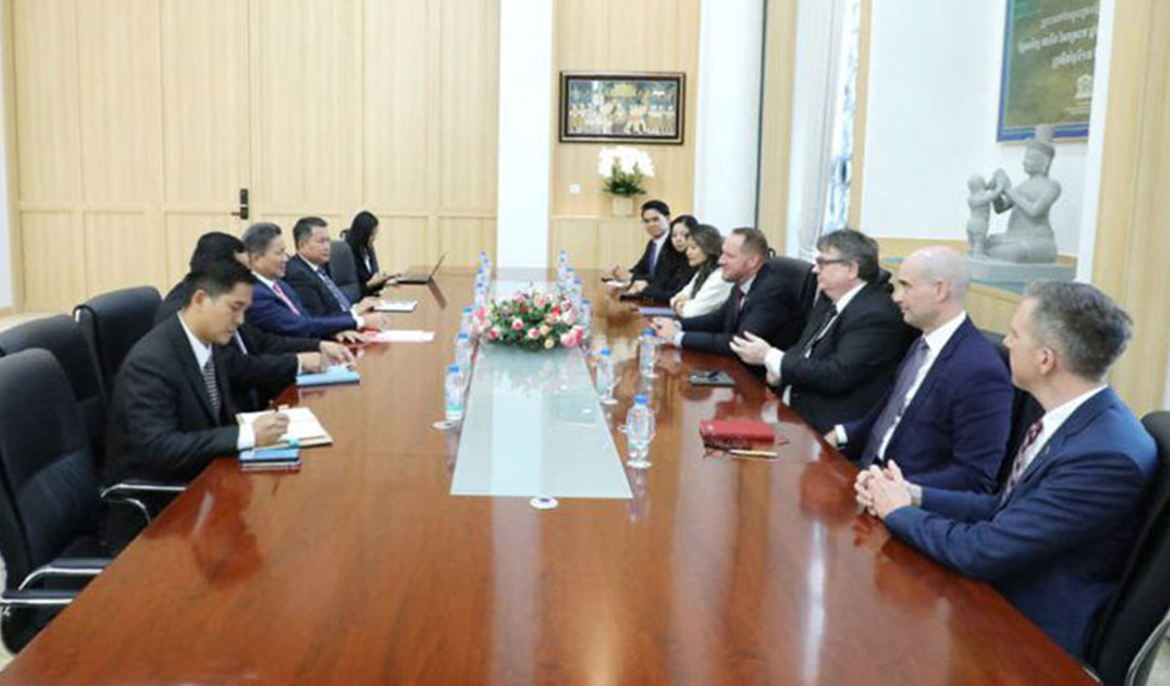

Sun Chanthol, Deputy Prime Minister and First Vice President of the CDC, noted during a meeting with a delegation from the American Chamber of Commerce in Cambodia (AmCham Cambodia) last week, that the CDC’s improvements of the technology surrounding the QIP registration system will better facilitate US and other international investors to apply for potentially-qualified investment projects in the Kingdom from their home nations, removing physical barriers for QIP applications.

An online system should also allow shareholders to understand the project’s feasibility under the preferential investment scheme more efficiently.

In order to stimulate more awareness from US-based firms in QIPs and other potential investments, Chanthol also said to the American trade delegation that the CDC is planning to make more visits to the country in the coming periods to promote such opportunities and ultimately attract more US investment into the Kingdom.

Pursuant to the Law on Investment 2021, a QIP is an investment project that has received a Final Registration Certificate (FRC) from the CDC and is therefore entitled to receive fiscal and non-fiscal incentives from the Cambodian Investment Board (CIB).

QIPs are given such incentives to operate in Cambodia as they are seen as having a positive impact on the economy.

The three categories of QIPs in Cambodia include ‘domestic qualified investment projects’, ‘export qualified investment projects’ and ‘supporting industry qualified investment projects.’

Foreign companies that are registered as QIPs can benefit from either a special tax exemption or a special tax depreciation.

QIP status can allow income tax exemptions for as long as the first nine years of operations, export tax exemption, and full import duty tax exemption on construction materials, equipment and production imports, among other tax benefits.

According to the regulation, QIPs that don’t choose to take advantage of the special tax exemption are entitled instead to a special depreciation allowance of 40 percent of the value of new or used tangible properties used by the company for production or processing.

The special depreciation allowance can be deducted during the first year of purchase of the tangible property, or the first year using such property.

Sisavuthara Sim, CEO of local advisory firm, Nexus Capital & Investment Advisory, told Khmer Times that the QIP program has played a significant role in bolstering Cambodia’s trade volume and investment revenues in recent years and should continue to attract more beneficial manufacturers to the Kingdom in the future.

The QIP program’s preferential tax treatment, along with a network of Special Economic Zones (SEZ) nationwide which include production-ready industrial areas for incoming manufacturing firms, mean that potential foreign investors have very few risks for entry into the Cambodian economy, he said.

Meanwhile, for production companies, Cambodia represents a hub for regional and international trade opportunities for Cambodian-made export products, thanks to a large number of preferential trade treaties already in place, he said.

Cambodian-based producers, whether registered as QIPs or not, are supported by free trade agreements with global trading partners, including the intra-ASEAN Free Trade Agreements (FTA), the China-Cambodia FTA, the Cambodia-South Korea FTA, the Regional Comprehensive Economic Partnership (RCEP), along with other preferential trade tariff systems offered by trade partners, he explained.

Immediately, international producers launching production in Cambodia witness unique advantages that may not exist in their home nations, he said. khmertimeskh